Payroll

Earnings Statement

PAYROLL OFFICE

- Burroughs & Chapin #119

290 Allied Drive

- P.O. Box 261954

Conway, SC 29528-6054

843-349-2540

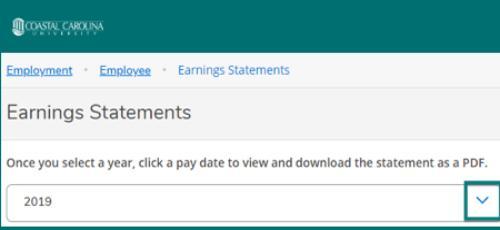

Download, view and print earnings statements

1. Log in to Employee Self Service/

2. Select Earnings Statements. The current year will be viewable but prior yeatrs can be accessed from the drop down menu.

3. To view a specific statement as a PDF, select the pay date from the menu to the right.

Please remember: If you are on a public or shared computer make sure you to log out of Self Service and close the browser once you are finished.

Reading and Understanding Your Earnings Statement

The new earnings statement is divided into five sections: employee overview; earnings; taxes, benefits and other deductions; direct deposit; and leave used (in hours).

The employee overview section includes your net pay amounts for the selected period as well as the year to date (YTD) amount up to the period selected. Your name, address, last four digits of your SSN, employee ID as well as position are also listed. Your taxation information (status, exemptions and additional withholdings) are included. Lastly, the pay period dates and pay date are also included in this section.

The second section on the earnings statement is your earnings for the period and year-to-date. It is important to note that even if you did not have earnings such as holiday pay or annual leave in the current period but you did have them during the calendar year, those earnings will display as null (-) for the current period but the year to date column will contain an amount. The earnings section includes a detailed listing of earnings types (i.e., classified pay, annual leave, sick leave employee, holiday pay, etc.), hours, rate, current period earnings and year-to-date earnings. Total gross pay (pay before taxes and benefits are deducted) is also listed.

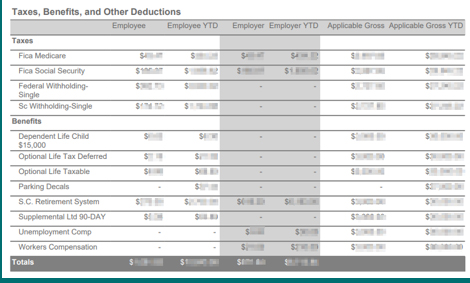

Taxes, Benefits and Other Deductions

In the taxes, benefits, and other deductions section you will find both the current and year to date (YTD) amounts for employee deductions and employer contributions for your taxes, benefits and other deductions.

To better understand this section let’s break it down even more:

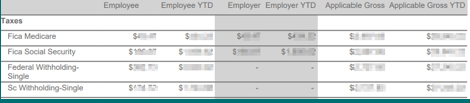

Taxes

Taxes are calculated from taxable earnings. FICA (Federal Insurance Contributions Act) Medicare tax is calculated at 1.45% of your applicable gross earnings. FICA Social Security tax is 6.2% of your applicable earnings. Federal and South Carolina withholding taxes are also deducted for those that do not claim exempt. Please contact the Payroll Office (843-349-2540 or payroll@coastal.edu) for questions about taxation and tax status.

The employee and employer both pay taxes on taxable earnings. The amounts calculated for employee taxes deducted are listed in columns Employee and Employee YTD. The amounts calculated for employer taxes contributed are listed in columns Employer and Employer YTD.

The last two columns display the applicable gross amounts for the current period as well as YTD. Applicable gross is also known as the total taxable eligible wages from which taxes are calculated. You are taxed only on your gross wages minus any pre-tax or tax deferred deductions.

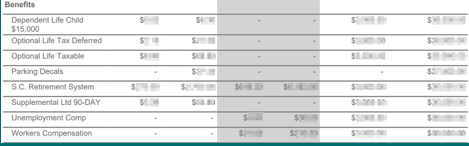

Benefits

This section includes detailed information about employee benefits and other deductions for the current period as well as YTD amounts. Just like with taxes, employers contribute towards benefits such as retirement and health insurance. Those amounts are listed under Employer and Employer YTD columns. If benefits or deductions are calculated using wages, then those current period and YTD wages will be displayed here under applicable gross and applicable gross YTD.

Lastly, totals are included for employee current and YTD amounts and employer current and YTD amounts.

The next section on the earnings statement is Deposit Information. This section lists the bank information, the last four account numbers and the deposit amount for each bank designated for direct deposit. To change your direct deposit information, please visit the Bank Information link in WebAdvisor or visit self-service banking information directly through the self-service website (coming in August 2019).

The last section on the earnings statement is Leave Used (in hours). This section details leave taken in hours during the current period. If you do not take leave during this period, but have taken leave during the calendar year, the amount displayed under this period will be 0.00.

If you have questions regarding your earnings statement, please contact Payroll at 843-349-2042 or payroll@coastal.edu.